Monthly mortgage for 1 million dollar home

VAs new COVID-19 Refund Modification provides multiple tools to assist certain borrowers in achieving a 20 reduction in the dollar amount for monthly PI mortgage payments. A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan.

This House Was Traded For A Red Paperclip Read About Each Of The 14 Trades Http Mc Mes Fm Dream Homes Paperclip House In Kipling Dream House Home Dream

Insurers use actuarial science to determine the rates which involves statistical analysis of the various characteristics of drivers.

. Every state has a different minimum coverage requirement making auto insurance coverage more expensive in some states than others but they remain lower. The USDA report released in August 2013 says the dollar value of trafficking increased to 13 percent up from 1 percent in the USDAs 20062008 survey and About 18 percent of those stores classified as convenience stores or small groceries were estimated to have trafficked. 224223 in cash to cover upfront expenses including a down payment and closing costs.

For instance if you are offering a 3-for-1 discount sale you can still advertise that in your emails and not get sent to spam. As inflation hits Americans consumer finance companies that cater to them like credit cards auto loans and mortgage originators could feel the heat. A step-by-step guide on how to retire on 1 Million Dollars for the rest of your life guaranteed.

Lower your mortgage rate. While million-dollar flats are still less than 2 of total transactions a record 259 public flats have been sold for S1 million or more last year official data shows and there have already. Sonix transcribes podcasts interviews speeches and much more for creative people worldwide.

Their monthly mortgage payment would be about 4100. But if it fits. Louis Missouri Gross annual income.

If you cant imagine living off 40000 a year plus Social Security its time to reconsider your savings goal. For example a 30-year fixed-rate loan has a term of 30 years. Make Make money.

An Adjustable-rate mortgage ARM is a mortgage in which your interest rate and monthly payments may change periodically during the life of the loan based. Also note that since the Tax Cut and Jobs Act went into effect the size of the loan on which you can deduct interest has dropped from 1 million to 750000 if you bought your house after Dec. You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

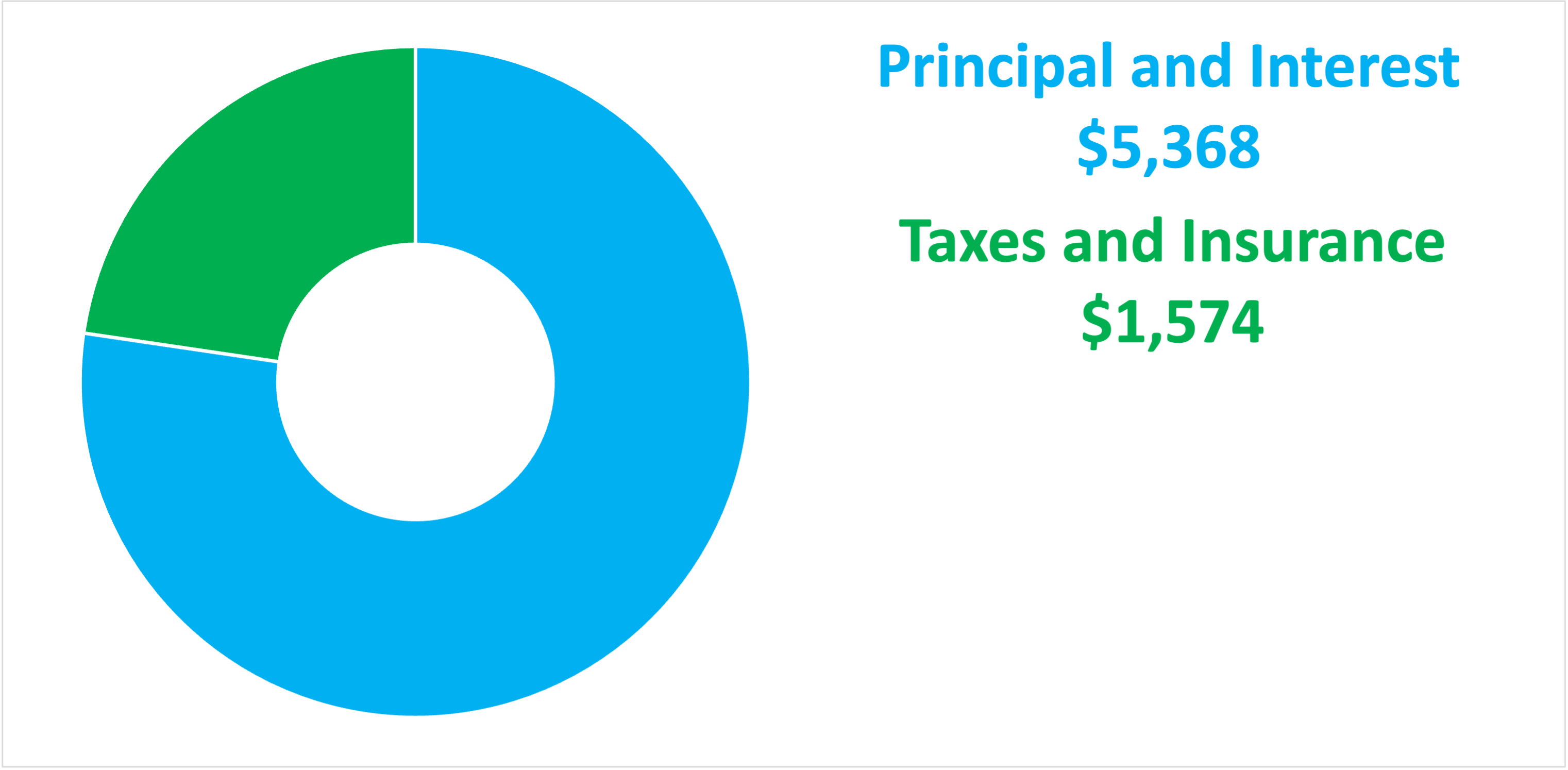

Financing a home purchase. A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and other factors. Mortgage rates drop to lowest level since April as high uncertainty creates volatility.

On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan. Sure a 15-year mortgage will come with a bigger monthly payment. Account for interest rates and break down payments in an easy to use amortization schedule.

Good 690-719 After plugging in these numbers HomeLight estimates that you can afford a home that costs 282997 with monthly. In the tables below well use an annuity with a lifetime income rider coupled with SSI to give you a better idea of the income you could. 25000 Amount of money for down costs.

Life insurance or life assurance especially in the Commonwealth of Nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person often the policy holder. High-dollar loans and longer repayment terms. If you instead opt for a 15-year mortgage youll pay over the life of your loan or about half of the interest youd pay on a 30-year mortgage.

September 9 2022. Currently the average 30-year jumbo APR for a home purchase is 5610 while the average 30-year conforming loan APR for a purchase is 5610 according to Bankrates survey of mortgage lenders. The automobile insurance market in the United States is a 308 billion US dollar market.

This borrower can afford a 1 million dollar house with an annual salary of 147000. To afford a 1 million home most buyers will probably need at least. 7 2022 at 130 am.

No debt with middle-of-the-road credit. Thats about two-thirds of what you borrowed in interest. But if you switch to a 15-year mortgage with a lower interest rate youll save almost 100000and youll pay off your home in half the time.

Depending on the contract other events such as terminal illness or critical illness can. Sonix is the best audio and video transcription software online. However higher limitations 1 million 500000 if married filing separately apply if you are deducting mortgage interest from indebtedness incurred before December 16 2017.

The average monthly Social Security Income check-in in 2021 is 1543 per person. The Loan term is the period of time during which a loan must be repaid. For Residents I need support paying rent andor utilities If you live in suburban Cook County.

Four percent of 1 million provides 40000 each year for retirement spending. Recovery Resources for Cook County residents and businesses Cook County remains dedicated to supporting residents and small businesses during these challenging times. In some cases.

Use our free mortgage calculator to estimate your monthly mortgage payments. Our industry-leading speech-to-text algorithms will convert audio video files to text in minutes. The 30-year fixed-rate mortgage averaged 499 as of August 4 according to data released by Freddie Mac.

If you keep the 30-year mortgage youll pay more than 158000 in total interest over the life of the loan. Its why over 100 million people put their trust in us every year. 225384 in annual household income to pay for ongoing costs including monthly mortgage payments maintenance insurance and homeowners association fees and taxes.

For larger stores supermarkets and large groceries only 032. Your total interest on a 1000000 mortgage. Another 31548 in cash.

If you or your business has been impacted by the pandemic and needs support please see our programs below.

Albert Gheisari Mortgage Brokers The Finance Conductors Call Fund 3863 Your Bank Connection Agheis Mortgage Brokers Mortgage Payoff Refinance Mortgage

How To Afford A 1 4 Million Dollar House In 2022 Real Estate Buying Dream House Million Dollar House

Architectures Ideas Latest Architecture Design Ideas For Home Commercial Hotels Curb Appeal Best Mortgage Lenders First Time Home Buyers

How To Buy A Million Dollar Home Matt O Neill Real Estate

7 Factors To Consider When Choosing The Right Home Location Elmens Immobilien Architektur Wohnung Kaufen

How To Get A 1 Million Home For 1 900 A Month The Leverage Provided By The Resurgence Of Inte Interest Only Loan Santa Barbara Real Estate The Neighbourhood

135 Million Dollar House In Aspen Colorado French Country Estate Mansions Beautiful Homes

Most Expensive Homes What One Month S Mortgage Can Buy Luxury Beach House Mansions Celebrity Houses

How Much Would My Payment Be On A 1 000 000 Mortgage Finder Com

Pin By Adriana Ghinaglia On Patio Facade Design Classic Facade House Facade Design

How To Afford A Million Dollar Home In 2022 Propertyclub

The Math Of Generating 1 000 000 Overnight Thing 1 Finanzas

What Is The Mortgage On A Million Dollar House

How To Afford A 1 4 Million Dollar House In 2022 Real Estate Buying Dream House Million Dollar House

1 Million Dollar Mortgage Mortgage On 1 Million Bundle

1 Million Homes For Sale Across The Country Expensive Houses Beautiful Homes Home

The Million Dollar Vintage Kit Homes That Come From Sears Liberty Home Bay City Bay City Michigan